Step-by-Step Guide to AI Funnels & Conversion for Accounting Firms

Why Accounting Firms Need AI Funnels & Conversion Now

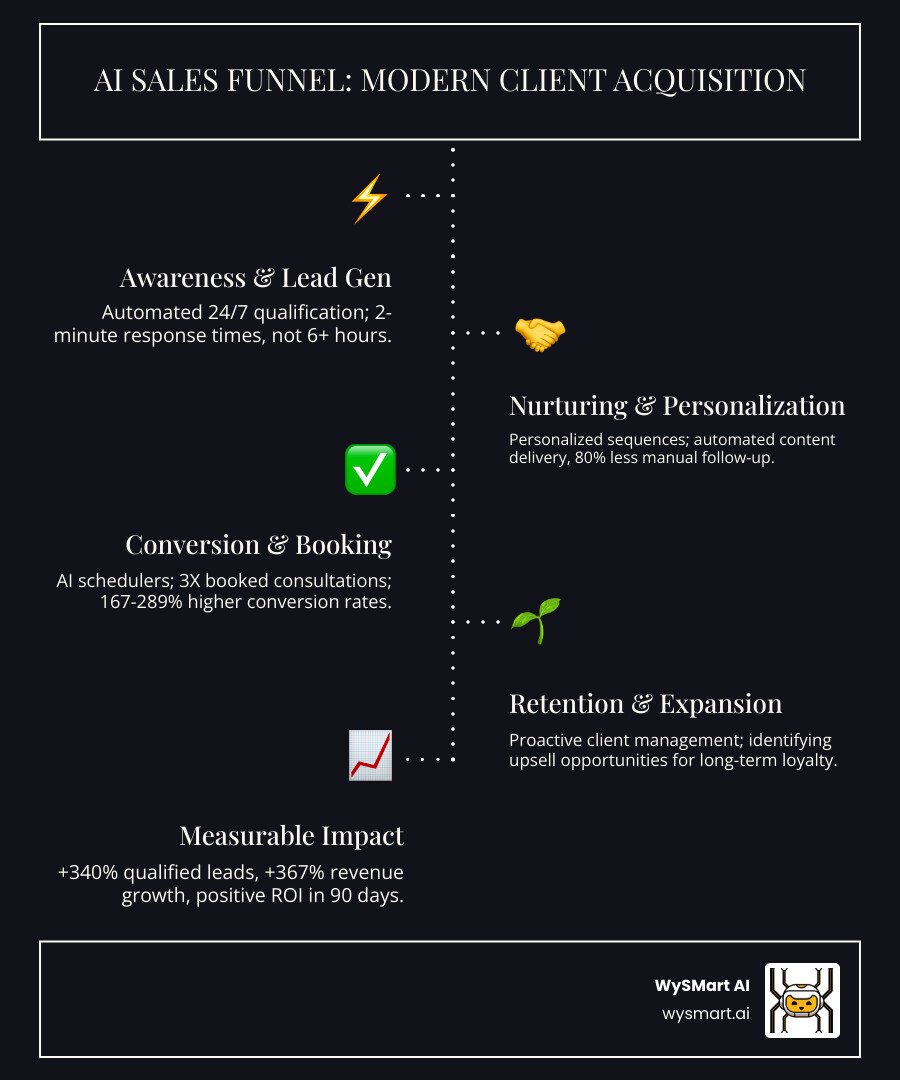

Accounting firms - AI funnels & conversion systems are no longer a futuristic concept; they are a present-day necessity for survival and growth. These intelligent systems are revolutionizing client acquisition by automating tedious lead qualification, delivering deeply personalized communication at scale, and slashing response times from hours to mere seconds. The tangible outcome for early adopters is staggering: up to a 3X increase in booked consultations, all while cutting the soul-crushing manual follow-up by a remarkable 80%.

Quick Answer: What You Need to Know

The Problem: The modern accounting client is impatient. Most leads require a complex service assessment, yet industry-average response times languish beyond 6 hours. This delay is fatal, causing firms to lose an estimated 61% of their hard-won prospects before a single conversation takes place. Leads go cold, opportunities vanish, and revenue is left on the table.

The AI Solution: Imagine a tireless digital assistant working for your firm 24/7. That's an AI funnel. It instantly engages, qualifies, and nurtures every lead with tailored, intelligent sequences, and seamlessly schedules qualified consultations directly onto your team's calendars—all without a shred of human intervention.

The Results: The data is unequivocal. Firms leveraging AI-powered funnels report a monumental +340% increase in qualified leads. Their conversion rates soar by 167% to 289%, leading to significant, predictable revenue growth across all service lines, from bookkeeping to high-value advisory.

The Investment: The barrier to entry is lower than ever. Basic AI automation tools start at an accessible $50-$200 per month per user. The financial upside is so immediate that most accounting firms achieve a positive return on investment (ROI) within the first 90 days.

The Framework: Successful implementation is not about a disruptive overhaul. It's a phased, strategic rollout. You begin by automating lead capture, then layer in automated nurturing sequences, and finally, optimize the full funnel with predictive analytics for a complete transformation.

The accounting profession is currently navigating a perfect storm. On one side, client expectations have been irrevocably shaped by the instant, personalized experiences offered by tech giants. They demand immediate answers and tailored solutions. On the other side, accounting teams are drowning in administrative work, spending a reported 72% of their valuable time on manual, non-billable tasks. This leaves little room for the strategic, high-value work that truly benefits clients and grows the firm. Traditional lead generation methods—relying on sporadic referrals, passive contact forms, and time-consuming manual follow-ups—are simply no match for the speed and efficiency of today's digital-first marketplace.

In stark contrast, AI-powered systems engage and respond to new leads in under 3 minutes, a critical window for capturing interest. This speed alone contributes to converting prospects at rates 167% higher than their manual-process counterparts. The evidence is overwhelming: firms that embrace intelligent automation are not just working more efficiently; they are fundamentally rewriting their growth story and creating an insurmountable competitive advantage.

This is not a narrative about replacing skilled accountants with robots. It's about empowerment. It's about providing your talented team with an AI co-pilot. This digital partner excels at the repetitive, predictable grind—initial lead qualification, persistent follow-ups, and calendar scheduling—freeing your human professionals to do what they do best: providing expert financial guidance, nurturing high-value client relationships, and focusing on strategic growth initiatives.

I'm Joey Martin, founder of WySMart AI. My career has been dedicated to helping businesses, particularly in the professional services sector, implement accounting firms - AI funnels & conversion strategies that deliver not just vanity metrics, but measurable, bottom-line growth. In this comprehensive guide, I will demystify how AI funnels operate, present the real-world results you can expect, and provide a detailed 5-step framework to implement these powerful systems in your practice in as little as 75 days.

What is an AI Sales Funnel and Why Does Your Firm Need One?

Picture your firm's traditional client acquisition process. Leads from your website, referrals, and marketing efforts trickle into a shared inbox or a basic spreadsheet. An already busy partner or associate is tasked with sifting through them, a process that often takes hours, if not days. By the time you finally reach out, a staggering 61% of those prospects have already engaged with a more responsive competitor. These are not just lost leads; they are lost revenue and a testament to a broken, outdated system.

An AI sales funnel is the definitive solution to this problem. It is a sophisticated, automated system that captures every single lead the moment they show interest, qualifies them based on predefined criteria, and nurtures them with deeply personalized, multi-channel communication—all while your team remains focused on delivering exceptional service to existing clients. It works by integrating cutting-edge artificial intelligence into every stage of the client journey, from initial awareness to final conversion, effectively giving your sales process a tireless, 24/7 digital assistant who never misses a beat or forgets a follow-up.

This transformative shift is powered by three core AI capabilities:

Hyper-automation: AI excels at executing the repetitive, time-consuming tasks that bog down your team. This goes beyond simple email templates. Think of AI handling initial lead qualification conversations via a chatbot, automatically logging all interactions in your CRM, scoring leads based on their engagement, and triggering complex follow-up sequences across email and SMS. This level of automation is how firms reclaim up to 72% of their team's time from administrative drudgery.

Predictive Insights: This is where AI becomes a strategic advisor. By analyzing thousands of data points—including website behavior, content engagement, firmographic data, and past conversion patterns—machine learning algorithms can predict with remarkable accuracy which prospects are most likely to convert, what specific services they need, and the optimal time to engage them. It’s the difference between casting a wide, hopeful net and surgically targeting prospects who are ready to buy.

Deep Personalization at Scale: Generic, one-size-fits-all marketing is dead. AI enables you to deliver custom-tailored messages based on each prospect's specific industry, expressed pain points, company size, and online behavior. A prospect in the construction industry who downloaded a guide on project-based accounting will receive a completely different nurturing sequence than a retail business owner who asked a chatbot about sales tax compliance. This builds trust and rapport on a massive scale, something that is impossible to achieve manually.

The cumulative effect of these capabilities is a dramatic increase in conversion velocity. This metric measures the speed at which a prospect moves through your sales cycle. By removing friction and personalizing the journey, AI shortens the time from a website visitor to a booked consultation, accelerating your firm's growth. While the foundational AIDA model (Awareness, Interest, Desire, Action) remains a valid framework, AI-driven execution makes it exponentially more efficient and powerful.

Accounting firms are uniquely positioned to reap massive benefits from this technology precisely because your services are complex and high-value. AI excels at handling the initial, often repetitive, information gathering and qualification stages. This crucial step filters out unqualified inquiries and arms your experts with the context they need before they even join the conversation, preserving your senior staff's time for the high-value strategic discussions that truly differentiate your firm. With studies showing that up to 86% of traditional accounting tasks have the potential for automation, implementing AI is no longer a competitive advantage—it is a fundamental requirement for future relevance and success.

Stage 1: AI for Awareness & Lead Generation (Top of Funnel)

Your top-of-funnel (TOFU) strategy must be built for the modern, always-on buyer. Prospects conduct research at all hours, and your firm must be ready to capture their interest the moment it peaks—whether that's at 2 PM on a Tuesday or 2 AM on a Sunday. Leaving them with a static, passive contact form is like closing your office doors to 90% of your potential clients. AI transforms your website from a digital brochure into an active, 24/7 lead generation engine.

AI-powered chatbots are the frontline soldiers of this transformation. Far from the clunky, frustrating bots of the past, modern conversational AI can conduct sophisticated, multi-step needs assessments. They ask intelligent, qualifying questions to understand a prospect's business, challenges, and service needs, all while providing immediate value. For instance, a custom-built Tax Complexity Analyzer chatbot can ask a series of questions to gauge a prospect's tax situation in minutes, then offer to schedule a call with the appropriate specialist. This single interaction builds immense trust and positions your firm as the expert solution before a human is ever involved. This is precisely why firms using AI see a 340% increase in qualified leads—they are not just getting more traffic; they are converting more of their existing traffic into viable opportunities.

At WySMart AI, we specialize in building these intelligent systems through our AI-powered website design services. We don't just build websites; we create high-performance conversion engines designed to capture, qualify, and convert prospects automatically, helping our clients achieve an average of 60% higher lead conversion rates from day one.

Stage 2: AI for Lead Nurturing & Personalization (Middle of Funnel)

Once a lead is captured, the race against time begins. A lead's interest has a short half-life. AI ensures that no lead ever goes cold or falls through the cracks. It replaces the sporadic, generic, and often-forgotten manual follow-ups with a systematic, intelligent, and persistent nurturing machine.

Automated follow-up sequences are the backbone of this stage. These are not simple email drips. They are multi-channel (email, SMS, LinkedIn messages) campaigns triggered by specific prospect actions. If a prospect downloads a whitepaper on international tax, the AI can send a series of emails with related case studies, blog posts, and an invitation to a relevant webinar. This systematic approach is how firms achieve an 80% reduction in manual follow-up work, freeing up countless hours.

Predictive lead scoring adds a layer of genius to this process. The AI analyzes hundreds of behavioral signals—pages visited on your website, time spent on each page, email open and click rates, content downloads, and even third-party intent data—to assign each lead a dynamic "readiness score." This score rises and falls in real-time based on their engagement. When a prospect's score crosses a predefined "hot lead" threshold, your team receives an instant alert, allowing them to reach out at the absolute perfect moment of peak interest. This is proactive, data-driven selling.

Finally, Personalized campaigns powered by Generative AI take nurturing to the next level. These tools can craft unique, context-aware messages that reference a prospect's specific journey, making them feel seen and understood, not just marketed to. This deep level of personalization is what builds the trust necessary for a high-value sale.

Stage 3: AI for Conversion & Consultation Booking (Bottom of Funnel)

This final stage is where the magic happens—converting nurtured interest into tangible action and revenue. AI's role here is to eliminate every possible point of friction in the final steps of the client's journey, accelerating bookings and closing deals faster.

AI-powered meeting schedulers are a simple but profoundly effective tool. They eliminate the frustrating and time-wasting email ping-pong of finding a mutually available meeting time. Prospects are presented with your team's real-time availability and can book a consultation slot with a single click. This simple change has been shown to lead to a 3X increase in booked consultations. You can experience this seamless process firsthand by booking your WySMart AI discovery call.

Once a meeting is booked, the work isn't over. Generative AI for proposals can create highly personalized, professional-looking proposals in minutes, not hours. By analyzing the data collected throughout the funnel (chatbot conversations, CRM notes, etc.), the AI can pull in the most relevant service descriptions, team member bios, and industry-specific case studies to create a compelling and tailored pitch. This final optimization of the entire journey transforms your firm from a collection of individual efforts into a cohesive, unstoppable client acquisition machine.

The 5-Step Framework to Build Your AI Sales Funnel

Implementing an accounting firms - AI funnels & conversion system can seem daunting, but it doesn't require a complete, disruptive overhaul of your current operations. At WySMart AI, we have perfected a proven 5-step framework designed to deliver measurable results within 75 days, all without overwhelming your team or interrupting your day-to-day business. It’s a strategic, incremental approach focused on generating early wins and building momentum.

Step 1: Audit Your Current Process & Define AI Objectives

Before we can build the future, we must thoroughly understand the present. The first step is a comprehensive audit of your existing client acquisition funnel. We map out every touchpoint, from the initial lead source to the final sale (or loss), to identify the specific points of friction and leakage where leads are slipping through the cracks. Is the bottleneck a slow response time? A poor lead handoff process? A lack of consistent follow-up? We'll document your current performance metrics—lead volume, website conversion rate, lead-to-consultation percentage, sales cycle length, and cost per acquisition—to establish a clear, quantitative baseline. You can't improve what you don't measure. With this data-driven understanding, we collaborate with your team to set specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, a goal might be: "Cut lead response time from 6 hours to under 5 minutes within 30 days" or "Increase the website lead-to-consultation conversion rate by 25% in the first quarter."

Step 2: Choose Your Tools & Integrate Your Data Stack

With clear objectives defined, the next step is to select the right AI tools for the job. The market is flooded with options, but we focus on a curated stack that delivers the most value for accounting firms. Key features we look for include intuitive dashboards, robust analytics and reporting, predictive forecasting capabilities, and powerful automation workflows. The most critical element of this stage is ensuring seamless integration with your existing Customer Relationship Management (CRM) system, email platforms, and calendars. A fragmented tech stack creates more problems than it solves. Data must flow freely between systems to create a single source of truth for each prospect. For accounting firms, ensuring uncompromising data compliance and security is non-negotiable. We exclusively implement solutions that feature bank-level encryption, are SOC 2 compliant, and adhere to regulations like GDPR and CCPA. At WySMart AI, we specialize in handling this complex technical heavy lifting, ensuring your data is both powerful and protected. You can explore more info about our integrated services to see how we build a cohesive and secure tech ecosystem for our clients.

Step 3: Implement AI Tools Incrementally

Attempting to implement everything at once is a recipe for failure. It overwhelms your team, creates resistance, and makes it difficult to measure the impact of any single change. Instead, we use a strategic, phased approach, starting with the area of greatest pain to generate a quick, impactful win.

Phase 1 (Days 1-30): Lead Capture & Qualification. We begin at the top of the funnel, where the biggest leaks often occur. We deploy an intelligent AI chatbot and dynamic smart forms on your website. This immediately addresses the critical issue of slow response times by engaging and qualifying leads 24/7, ensuring no opportunity is missed.

Phase 2 (Days 31-60): Nurturing Automation. With a steady stream of qualified leads now being captured, we introduce automated, personalized email and SMS sequences. This phase is designed to keep your firm top-of-mind and build trust with prospects who aren't ready to buy immediately. This is where we achieve that 80% reduction in manual follow-up work, freeing your team to focus on warmer prospects.

Phase 3 (Days 61-75+): Full Funnel Optimization. In the final phase, we layer in advanced capabilities. This includes activating predictive lead scoring to prioritize your team's efforts, implementing AI-powered scheduling to accelerate bookings, and leveraging generative AI for rapid proposal creation. This phase transforms your funnel into a fully optimized, end-to-end client acquisition machine.

Step 4: Measure, Analyze, and Iterate

An AI funnel is not a "set it and forget it" solution; it is a living, dynamic system that gets smarter over time. Continuous improvement is baked into our process. We constantly track key performance indicators (KPIs) against the baseline and goals we established in Step 1. We monitor conversion rates at each stage of the funnel, sales cycle length, client acquisition cost, and ultimately, return on investment.

Using behavioral analytics, we can see exactly how prospects interact with your funnel. Which chatbot questions cause drop-offs? Which emails get the highest engagement? We then use A/B testing to systematically optimize every element. We test different email subject lines, calls-to-action (CTAs), landing page headlines, and chatbot conversation flows. This rigorous, data-driven approach ensures that your funnel becomes more efficient and effective every single week, compounding small, incremental gains into transformative, long-term results.

The Measurable Impact: Benefits & ROI of AI Funnels & Conversion for Accounting Firms

The decision to adopt an AI-powered sales funnel is not a leap of faith; it is a strategic investment that delivers real, measurable results impacting both your firm's bottom line and your team's day-to-day experience. This is about tangible, quantifiable outcomes that touch every aspect of your practice, from revenue growth to employee morale.

When accounting firms partner with WySMart AI to implement these funnels, the impact is often immediate and profound. They witness higher lead-to-consultation rates, significantly shorter sales cycles, and a predictable uplift in monthly recurring revenue. Perhaps more importantly, the crushing manual workload that consumes up to 72% of your staff's time begins to evaporate. This fundamental shift dramatically improves job satisfaction. When talented professionals are freed from repetitive administrative tasks, they can focus on the strategic, client-facing work they were hired to do. Companies that embrace this level of automation report 34% higher employee satisfaction and 52% better quota attainment for their sales-focused staff. Your team feels more fulfilled, more productive, and every client acquisition decision becomes backed by clear, unbiased data-driven insights rather than guesswork.

The Jaw-Dropping ROI for Accounting Firms

The statistics gathered from accounting firms that have successfully adopted AI-powered sales strategies are nothing short of transformative. Across all major service lines, the results paint a clear picture of exponential growth:

Business Advisory Services: +412% lead volume, +289% conversion rate improvement, and +367% revenue growth.

Bookkeeping & Compliance Services: +356% lead volume, +245% conversion rate improvement, and +298% revenue growth.

High-Value Multi-Service Clients: +567% lead volume, +423% conversion rate improvement, and +489% revenue growth.

This is not theoretical data. This is aggregate, anonymized data from a cohort of 67 accounting firms that implemented accounting firms - AI funnels & conversion strategies over a 12-month period. The return on investment can be astronomical, with some firms modeling the potential for over 36,000% annual ROI based on the value of new clients acquired. More pragmatically, the vast majority of organizations achieve a positive ROI within the first 90 days. This rapid return is driven by the dual benefits of winning more clients through higher conversion rates and simultaneously lowering the cost of acquisition through massive productivity gains.

Consider a simple, hypothetical scenario: A firm invests $1,000 per month in a comprehensive AI funnel solution. In the first 90 days, the system helps them land just one additional multi-service client with an annual value of $25,000. The initial 3-month investment of $3,000 has already yielded an 833% return, a figure that continues to grow with each new client the system acquires.

The Human Element: AI as a Co-Pilot, Not a Replacement

Let's address the elephant in the room with absolute clarity: AI augments, not replaces, skilled accountants. The fear of replacement is understandable but misplaced. AI serves as a powerful co-pilot, expertly handling the repetitive "science" of sales—the data analysis, the persistent follow-ups, the scheduling logistics—while freeing up your human staff for the high-value "art" of sales. This allows your professionals to dedicate more of their precious time to revenue-generating activities that require a human touch: building genuine rapport with prospects, understanding nuanced business challenges, providing strategic financial advice, and nurturing long-term client relationships.

Your team doesn't become obsolete; they become more strategic, more efficient, and ultimately, more valuable to your clients. As noted in a recent article on AI's role in tax firms, AI is a critical lever for increasing productivity and dramatically accelerating the sales cycle. A key part of our role at WySMart AI is to help firms navigate the human side of this transition. We overcome adoption challenges through our incremental implementation model, comprehensive team training, and clear communication, ensuring your team feels empowered and supported by the new technology, not threatened by it.

The Future of AI in Client Acquisition

The accounting profession is standing at the precipice of a fundamental, technology-driven shift in client acquisition. The AI capabilities available today, as powerful as they are, represent just the first wave of innovation. Firms that embrace these tools now are not just gaining a temporary edge; they are building a foundational competency that will allow them to dominate their markets for the next decade and beyond.

Generative AI for hyper-personalization is rapidly evolving beyond simple mail-merge fields. In the near future, AI will craft entirely unique, multi-paragraph messages that feel as if they were personally written for each prospect by a senior partner. Imagine an AI system automatically sending an email that says, "Hi Sarah, I noticed you downloaded our guide on succession planning for family-owned businesses and also reviewed the profile of our partner, David Chen. Many of our clients in the manufacturing sector, like you, face complex challenges in transitioning leadership. We recently helped a similar firm navigate this process, resulting in a 20% increase in enterprise value. David has an opening on Thursday to discuss how we might achieve a similar outcome for you." This level of tailored outreach, sent automatically at the perfect moment, is the future of engagement.

AI-powered sales coaching is also moving from concept to reality. These systems will analyze sales calls and video meetings in real-time, using natural language processing to understand the conversation's flow, sentiment, and content. The AI will then provide on-screen prompts and talking points to the accountant. For example, it might flash an alert saying, "Prospect mentioned 'cash flow issues.' Suggest our cash flow forecasting service." Or it might display a relevant case study or testimonial on the screen that the accountant can reference immediately. It's like having an expert sales coach whispering in your ear on every call, helping teams improve their quota attainment by as much as 28% in just 90 days.

We are also witnessing the rapid rise of autonomous sales agents. These are a significant leap beyond today's chatbots. These AI agents will live in your CRM and be capable of executing entire outreach campaigns independently. They will identify target prospects, conduct multi-step conversations over email, intelligently handle objections, negotiate meeting times, and place fully qualified, pre-warmed appointments directly onto your team's calendar. Imagine starting your Monday morning with a calendar already full of high-potential prospects who have been vetted and primed for a strategic conversation.

Looking further ahead, by 2027, these disparate technologies will likely converge into unified AI-driven revenue platforms. These platforms will not only manage the entire client acquisition funnel but also predict deal outcomes with over 90% accuracy, forecast future revenue with unprecedented precision, and even identify cross-sell and up-sell opportunities within your existing client base before the client even realizes they have a need. For accounting firms - AI funnels & conversion strategies, staying ahead of this curve is not just about growth; it's about survival. The competitive advantage for early adopters is massive and compounding. While your competitors are still manually sifting through leads and crafting follow-up emails, your firm will be automatically capturing and converting the best leads in your market before anyone else even knows they exist.

At WySMart AI, our mission is to build these future-ready systems for our clients today. Our done-for-you AI toolbox is not a static product but an evolving platform that integrates the latest, most effective technologies into a simple, unified system. We handle all the underlying complexity so you can focus on what you do best: providing exceptional financial guidance to your clients.

Frequently Asked Questions about AI Funnels for Accounting Firms

How much does it cost to implement AI in sales for an accounting firm?

The cost of implementing an AI sales funnel is far more accessible than most firm partners assume, and the focus should always be on the return, not just the expense. The investment can be broken down into tiers:

Basic Automation Tools: For firms just starting out, tools that automate specific tasks like email sequencing or social media posting typically range from $50-$200 per user per month. These are good entry points but often lack deep integration and intelligence.

Comprehensive AI Platforms: More robust, all-in-one platforms that include an AI-powered CRM, chatbot, lead scoring, and analytics can range from $500-$2,000+ per month for a small team. Many of these providers, including WySMart AI, offer scalable pricing models designed for small and mid-sized firms, ensuring the solution grows with you.

The real question isn't about cost, but about ROI. With most firms reporting a 15-25% increase in conversion rates and a 20-35% improvement in team productivity within the first few months, the systems quickly pay for themselves. Most of our clients see a positive ROI within 90 days. At WySMart AI, we believe in transparency and partnership, which is why we offer scalable solutions backed by a risk-free trial and a money-back guarantee. You can see the value before committing long-term. See our services page for more details on our pricing philosophy.

How does AI qualify leads differently from traditional methods?

This is one of the most profound differences. Traditional lead qualification is static and often relies on manual methods like the BANT framework (Budget, Authority, Need, Timeline), which is gathered through a rigid form or an initial discovery call. It provides a limited, one-time snapshot.

AI-powered qualification, by contrast, is dynamic, multi-dimensional, and continuous. It analyzes hundreds of real-time behavioral and contextual signals that a human could never track. These include:

Behavioral Data: Which specific pages a prospect viewed, how long they stayed, which videos they watched, which emails they opened and clicked.

Firmographic Data: The prospect's industry, company size, revenue, and location, pulled from data enrichment sources.

Intent Data: Signals from across the web indicating that a company is actively researching solutions like yours.

This data feeds a real-time lead scoring model that constantly updates a prospect's "readiness" to buy. The AI doesn't just ask if they have a need; it infers the urgency of that need based on their actions. It flags prospects as "hot" the moment they exhibit a cluster of buying signals, allowing your team to follow up at the precise moment of maximum interest. It's the difference between fishing with a single hook and a spear (traditional) versus using a sophisticated sonar system to find exactly where the fish are schooling (AI).

What are the main risks of using AI in the sales process?

While the benefits are immense, a prudent firm must consider and mitigate the potential risks. The three primary risks are:

Over-reliance on Automation & Loss of Human Touch: There is a real danger that an improperly configured system can feel robotic and impersonal, alienating prospects. Complex negotiations, building deep rapport, and handling sensitive client discussions will always require human empathy and judgment. The goal is always augmentation, not abdication.

Data Privacy and Security Concerns: For accounting firms, this is the most critical risk. You are custodians of highly sensitive client financial data. It is imperative to use AI tools with stringent, bank-level security protocols, end-to-end encryption, and clear data governance policies. Vendor due diligence is crucial; you must ensure they are SOC 2 compliant and adhere to all relevant data privacy regulations (e.g., GDPR, CCPA).

Initial Learning Curve and Team Adoption: Any new technology requires a period of adjustment. Without a proper change management plan, you may face resistance from staff who are comfortable with old workflows, leading to a temporary dip in productivity. This is a significant risk if not managed proactively.

These risks are entirely manageable with the right strategy. They are mitigated by maintaining strict human oversight on all automated communications, choosing secure and compliant technology partners, and using an incremental implementation approach that includes comprehensive team training and support. These mitigation strategies are core to the WySMart AI implementation process, ensuring a smooth and successful transition.

Conclusion: Stop Guessing, Start Winning with AI

The evidence is overwhelming, and the conclusion is clear: accounting firms - AI funnels & conversion systems are not a passing trend but a fundamental re-architecting of how modern firms win and retain clients. The antiquated days of passively waiting for referrals and manually chasing down cold leads are definitively over. The future—and the present—belongs to forward-thinking firms that embrace intelligent automation not as a replacement for their expertise, but as a powerful amplifier of it.

We're not talking about marginal improvements. We are talking about transformative results: lead volumes skyrocketing by over 400%, conversion rates making quantum leaps of 167% to 289%, and firms booking 3X more qualified consultations without adding a single new staff member. These are the real-world outcomes from firms that made the strategic decision to stop guessing and start building a data-driven growth engine. The real victory, however, is the liberation of your team. Your most valuable assets—your skilled accountants and partners—are freed from the repetitive administrative grind that used to consume an astonishing 72% of their time. They get to reinvest that time in high-value strategic work, client relationships, and professional development.

At WySMart AI, our mission is to make this powerful transition seamless and profitable for you. Our done-for-you AI toolbox is meticulously designed to handle all the complexity on the backend. From AI-powered website design services that turn anonymous visitors into qualified leads, to sophisticated, automated nurturing sequences that fill your calendar with warm appointments, we manage the technology so you can focus on your clients.

Think about this: while your competitors continue to lose 61% of their potential clients due to slow, inconsistent responses, your AI-powered system will be capturing, qualifying, nurturing, and scheduling meetings with those same prospects in minutes. This isn't just a competitive edge—it's like playing a completely different game, with rules stacked in your favor.

We are so confident in our ability to transform your client acquisition process that we stand behind our work with a risk-free trial and an unconditional money-back guarantee. We want you to see the results and feel the impact on your firm's growth and your team's morale for yourself.

The accounting profession is at a historic crossroads. The firms that act decisively and adopt AI now will build an insurmountable lead and dominate the next decade of the industry. The window of opportunity for early-adopter advantage is closing faster than you think.

Are you ready to stop leaving revenue on the table and turn your client acquisition process into a predictable, automated growth engine? Start your 7-day free trial and get free leads today. Let's work together to make sure your future clients find you first.