Robots in the Ledger: AI Automation for Accounting Firms

Why AI for Accounting Firms is No Longer Optional

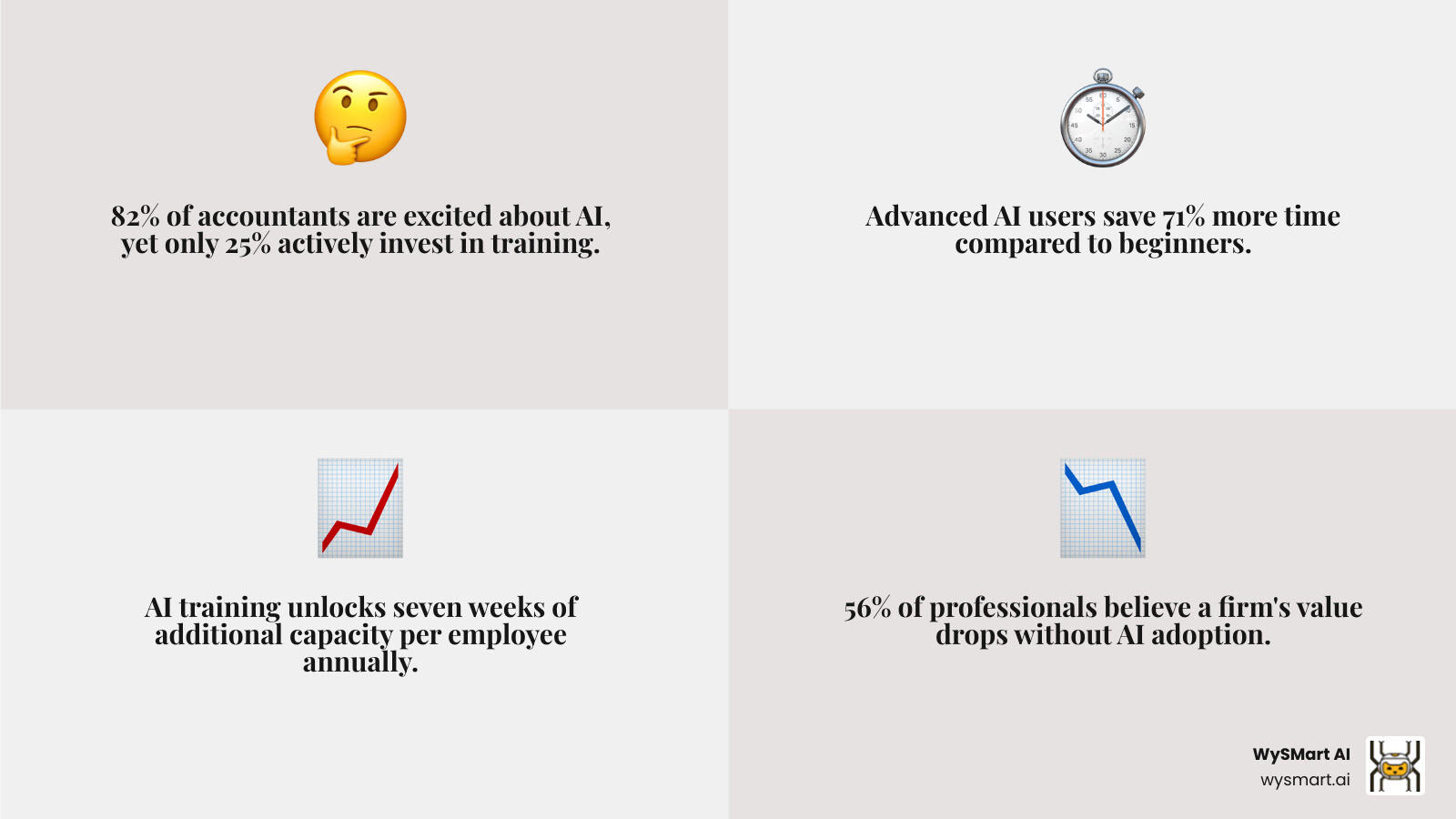

AI for accounting firms has shifted from a "nice-to-have" to a strategic necessity. While 82% of accountants are excited about AI's potential, only 25% are actively investing in training, creating a massive competitive gap for firms ready to accept automation.

Core AI Applications for Accounting Firms:

Data Preparation & Bookkeeping: Automated transaction categorization, reconciliation, and error detection

Tax Services: AI-powered research, deduction identification, and return preparation assistance

Audit Support: Risk analysis, fraud detection, and document review automation

Client Communication: Email composition, meeting transcription, and report generation

Advisory Services: Predictive analytics, cash flow forecasting, and strategic insights

Marketing & Growth: Content creation, client onboarding, and lead nurturing

The numbers tell the story: advanced AI users save 71% more time than beginners, and firms investing in AI training open up seven weeks of additional capacity per employee annually. Meanwhile, 56% of professionals believe a firm's value drops without AI adoption.

The change is already happening. Big 4 firms are embedding AI into audit processes, while smaller practices leverage it for bookkeeping, tax research, and advisory services. Real firms are seeing dramatic efficiency gains, from automating mail processing to generating technical memos in 30 minutes instead of four hours.

However, this revolution has challenges. Data security concerns affect 70% of professionals, and reliability issues require careful management. The key is a strategic start: identifying pain points, implementing training, and maintaining human oversight.

I'm Joey Martin, founder of WySMart.ai. I've helped hundreds of businesses use AI for growth. Through our work with professional firms, I've seen how AI for accounting firms can transform operations while keeping the human expertise clients value.

The AI Revolution in Action: How Firms Are Boosting Efficiency and Accuracy

The age-old image of accountants hunched over ledgers is obsolete. Today, AI is a strategic partner reshaping how accounting firms operate. Industry studies show advanced AI for accounting firms users save up to 71% more time than beginners, a difference that translates into increased capacity. AI isn't replacing human intelligence but augmenting it, allowing teams to achieve new levels of accuracy and efficiency.

Imagine repetitive, time-consuming tasks handled in minutes by intelligent automation. This is the present reality for firms leveraging AI. From data preparation to complex audits, AI is a game-changer, freeing up valuable human capital for more strategic, client-facing work.

Automating the Mundane: Data Preparation, Bookkeeping, and Payroll

One of the most immediate impacts of AI for accounting firms is automating the mundane yet essential tasks that form the backbone of accounting. AI acts as a tireless digital assistant, handling repetitive work so your team can focus on what truly matters.

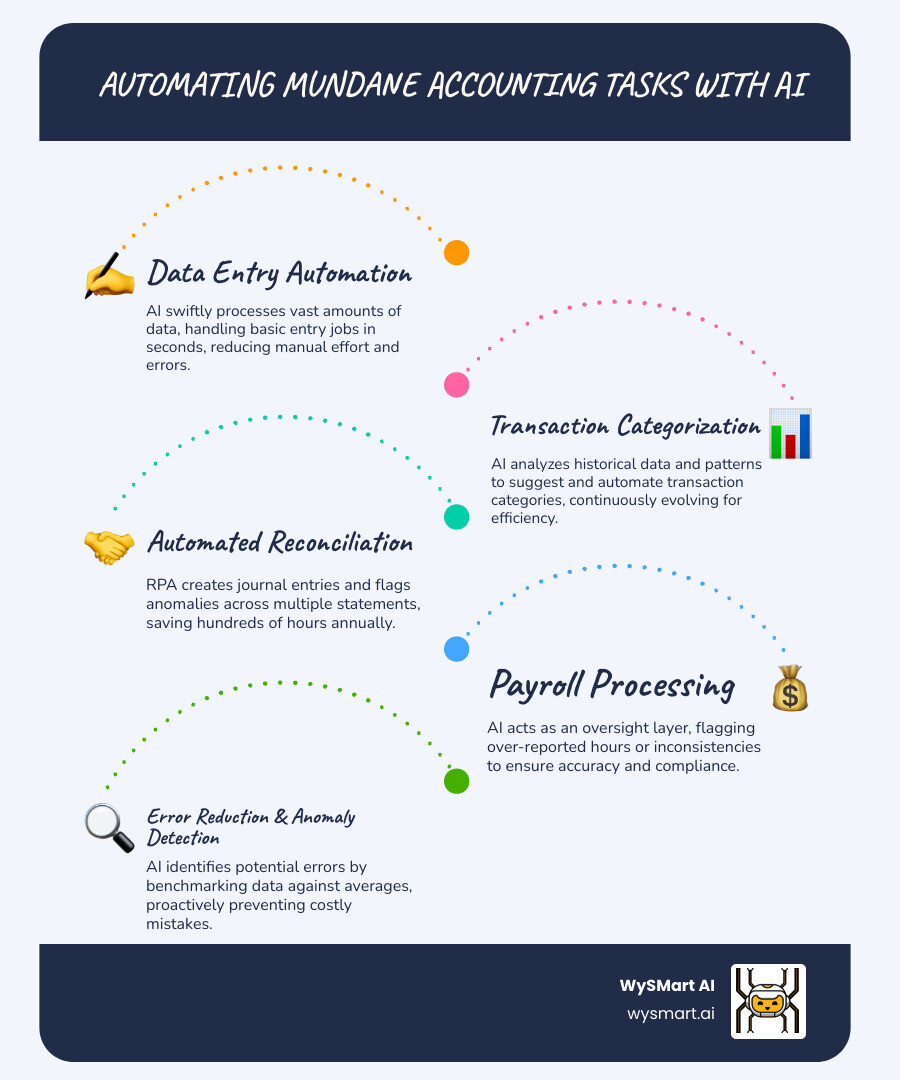

Data entry automation: AI swiftly processes vast amounts of data, handling basic data-entry jobs in seconds to reduce manual effort and human error.

Transaction categorization: Platforms like QuickBooks Online use AI to analyze and suggest transaction categories based on historical data, with plans for even more automation.

Automated reconciliation: A "digital worker" using Robotic Process Automation (RPA) can process over 100 investment statements, create journal entries, and flag anomalies. One firm saved approximately 500 hours per year with this method.

Payroll processing: AI can act as an oversight layer, flagging over-reported hours or inconsistencies in payroll data to ensure accuracy.

Error reduction and anomaly detection: AI automatically identifies potential errors by benchmarking data against averages and flagging outliers, preventing costly mistakes.

By automating these foundational processes, firms can boost efficiency, reduce costs, and reallocate talent to higher-value activities.

Enhancing Core Services: Auditing and Tax Preparation

AI for accounting firms is also revolutionizing core services like auditing and tax preparation, turning them into data-driven, insight-rich engagements.

Risk identification & Data analysis for audits: Leading firms like EY embed AI into their audit processes to analyze unstructured data (like contracts) and massive datasets to identify risks, including fraud. Tools like the AICPA’s Dynamic Audit Solution analyze large datasets to pinpoint discrepancies, processing documents much faster than manual review.

Fraud detection: By analyzing transaction patterns, AI can detect potential fraudulent activities that might be missed by human review.

Tax research automation: "More and more tax professionals are turning to AI to leverage its capabilities and effectively manage tax operations." AI-powered tax research tools provide quick, accurate answers by sifting through vast legal precedents and tax codes.

Deduction and credit identification: AI-improved tax software uses machine learning to identify potential deductions and credits, ensuring clients maximize their tax benefits.

Document review: Deloitte developed an automated platform to evaluate contracts and invoices to find key info and identify anomalies. Smaller firms can also use AI for quicker analysis. For example, one firm used generative AI and Retrieval-Augmented Generation (RAG) to cut the time for drafting accounting memos from four hours to 30 minutes (with human review).

These advancements empower professionals to conduct more thorough audits, provide more accurate tax advice, and deliver superior value.

Elevating Client Value: Advisory, Communication, and Marketing

The true power of AI for accounting firms is its ability to transform client relationships and fuel growth. By automating back-office tasks, AI frees accountants to become proactive, strategic advisors.

Financial planning & analysis (FP&A): AI-driven tools improve forecasting accuracy, highlight areas for cost savings, and provide advanced analytics on industry trends to aid in strategic decision-making.

Predictive insights: With AI, firms can offer predictive insights, helping clients plan for future tax implications or market shifts.

Client performance reports: AI can generate detailed client performance reports in minutes, enabling accountants to scale advisory services. Clients often find these AI-generated visuals clearer than traditional reports.

Email composition: 64% of accountants already use AI to compose emails and fine-tune their writing tone.

Meeting transcriptions: About 40% of accountants use AI to transcribe meetings, automatically generating action items and summaries.

Scaling advisory services with AI: By offloading mundane tasks, firms can shift from low-dollar transactional services to higher-value advisory work. As one expert put it, AI won't replace CPAs; it will allow them to focus on higher-value tasks, changing their role into a human-centric advisory one.

AI-powered marketing for accounting firms: This is where WySMart.ai shines. We empower firms to use AI for growth and client acquisition. Our done-for-you AI toolbox automates landing page creation for SEO, making your firm stand out. We can develop custom GPTs as client-facing tools to generate leads. Our platform drives growth with AI-optimized SEO, campaign insights, and tools for drafting replies, landing pages, and proposals. We provide comprehensive digital marketing services—from website design to social media—all powered by AI to help you market your high-value advisory services.

With AI for accounting firms, the potential to lift client service and streamline marketing is immense. Learn more about WySMart.ai's AI-powered marketing solutions and how we can help your firm thrive in this new era.

Opening up the Benefits: Why AI for Accounting Firms is a Game-Changer

Adopting AI for accounting firms redefines efficiency, accuracy, and growth. Firms using AI aren't just keeping pace; they're setting it. Investing in AI can open up up to seven weeks of additional capacity per employee annually—a strategic edge that can transform your firm.

Boost Productivity and Capacity

The most tangible benefit of AI is its ability to dramatically improve productivity and capacity, fundamentally changing the daily workflow of accounting professionals.

Time savings: Advanced AI users save 71% more time than beginners. With AI training, employees save 22% more time (about 40 hours annually). For example, processing mail can be cut to 20 minutes, saving four hours weekly. Technical memos can be drafted in 30 minutes instead of four hours.

Increased efficiency: AI "presents an opportunity to improve efficiency and quality of service." Generative AI has been reported to deliver 20% to 50% productivity gains in development processes.

Task automation: By automating repetitive tasks like data entry and reconciliation, AI frees up your team from monotonous work.

Ability to handle more clients: With AI handling routine processes, professionals can tackle more complex projects, enabling firms to serve a larger client base.

Focus on high-value advisory work: The time saved allows accountants to shift from administrative tasks to strategic activities like financial analysis, tax planning, and client relationship management.

Improve Accuracy and Reduce Costly Errors

In accounting, errors are costly. AI for accounting firms acts as a powerful safeguard, improving accuracy and reducing the incidence of human error.

Error reduction: 68% of professionals are excited about AI's potential for error reduction. AI automatically identifies potential errors by benchmarking against averages and flagging anomalies.

Anomaly detection: AI-powered digital workers can automatically point out anomalies in financial data, ensuring discrepancies are caught early.

Compliance improvement: AI can automate compliance processes, ensuring firms adhere to regulatory requirements more consistently.

Mitigating human error: By automating data processing, AI drastically reduces the likelihood of human error in financial reporting.

Real-world examples of costly errors prevented by AI: The Molson Coors Brewing Co. saga is a stark reminder of the cost of human error. In 2019, a $248 million accounting error forced them to restate fiscal reports, causing a 6.4% drop in share value. AI's ability to cross-reference and flag inconsistencies can prevent such catastrophic damage.

Attract Top Talent and Boost Firm Valuation

In today's competitive landscape, technology adoption is critical for talent acquisition and firm valuation. AI for accounting firms helps you stand out.

Attracting graduates who prefer AI-enabled firms: A compelling 76% of professionals believe graduates are more likely to join firms that actively use AI and other advanced technologies.

Modernizing the firm: Embracing AI signals that your firm is innovative, adaptable, and committed to providing the best service.

Increasing firm value: The market recognizes the strategic advantage of AI. A significant 56% of professionals believe a firm's value drops if it doesn’t use AI.

Industry surveys show firms without AI risk losing value: This statistic is a clear indicator that AI adoption is becoming a prerequisite for maintaining and growing firm valuation.

Navigating the Problems: A Strategic Approach to AI Implementation

While the benefits of AI for accounting firms are undeniable, successful implementation requires a strategic roadmap and a clear understanding of the challenges. Adopting AI demands a thoughtful, risk-managed approach. As CPA.com highlights, "Risk management and a clear roadmap are essential for successful AI adoption."

Overcoming Key Challenges for AI in Accounting Firms

Being aware of these challenges and having strategies to address them is crucial for AI integration.

Data security concerns: A top worry for 70% of professionals, data security is a major concern. Entering data into a generative AI tool means sharing it with the tool's owners, raising questions about access and protection. We strongly advise prohibiting the sharing of confidential client data with general-purpose AI tools and performing due diligence on vendor security protocols.

Reliability of AI output: AI models are not infallible and can produce incorrect output. Today's Large Language Models (LLMs) generate text, not computed answers, so they shouldn't be trusted indiscriminately with financial analysis. AI often lacks the nuanced context critical for accounting.

Ethical considerations: The use of AI in accounting brings forth ethical questions, from bias in algorithms to implications for professional judgment. Understand the ethical considerations with AI in accounting is a critical resource for guidance.

Professional liability risks: Indiscriminate reliance on AI can lead to errors or omissions, potentially resulting in professional liability claims. The firm bears responsibility for incorrect AI-generated advice.

Addressing AI "hallucinations" and ensuring accuracy: AI "hallucinations" (plausible but incorrect information) are a real risk. To mitigate this, always maintain a "human in the loop" for review. Techniques like Retrieval-Augmented Generation (RAG), which involves feeding AI verified examples, can minimize hallucinations. It may be more cost-effective to wait for vendors to develop off-the-shelf AI products with built-in safeguards.

Industry guidance on managing AI risks: Organizations like the AICPA and CPA.com provide valuable resources to help firms steer these complexities. Learn more about navigating the AI landscape from the AICPA.

Building Your AI Roadmap: Strategy, Training, and ROI

A successful AI journey requires thoughtful planning. Here's how to build a robust AI roadmap for your firm:

Developing an AI policy: This should define appropriate uses, prohibit sharing confidential information with general AI tools, and advise personnel to treat AI inputs with care.

Starting with small, high-impact projects: Identify specific pain points—time-consuming, repetitive, or error-prone tasks—and seek AI solutions for those first. Small pilots build momentum.

Identifying pain points: Ask your team: "What part of your day do you wish AI could just do for you?" This user-centric approach ensures you solve real problems.

Investing in employee training: While 82% of accountants are excited by AI, only 25% are investing in training. This gap is an opportunity. Firms that invest in AI training see employees save 22% more time annually. Leaders must empower teams through education on AI policies and continuous learning.

Measuring success and ROI: Track key metrics like time saved, reduction in error rates, increased capacity for advisory services, and improved client satisfaction to demonstrate the value of your AI initiatives.

Step-by-step guide to AI implementation:

Assess Needs: Identify pain points and opportunities for automation.

Research Solutions: Explore AI tools that address your needs and align with your budget.

Pilot Program: Start with a small, manageable pilot project to test the technology.

Develop Policies: Create clear, firm-wide guidelines for AI use.

Train Your Team: Provide comprehensive training on how to use AI tools effectively.

Implement & Monitor: Roll out successful pilots more broadly, continuously monitoring performance.

Iterate & Scale: As you gain experience, identify new areas for AI integration.

For a quick map of things to consider, download the Road to AI Implementation guide from CPA.com.

The Future is Now: AI's Lasting Impact on the Accounting Profession

The narrative around AI for accounting firms is one of profound change, not fear. AI is a catalyst, the "great equalizer," helping firms of all sizes compete. The future isn't about AI replacing accountants, but empowering them to reach new heights of strategic impact.

The Evolving Role of the CPA in the Age of AI for Accounting Firms

The traditional image of a CPA is changing. AI is ushering in an era where the CPA becomes an indispensable strategic partner.

Shift to strategic advisory: Automating repetitive tasks allows accountants to "focus on more strategic activities," shifting from transactional to high-value advisory work. AI won't replace CPAs but will allow them to focus on impactful solutions, making "the future of accounting... human-centric advisory roles, augmented by AI."

Becoming a trusted business partner: AI lifts the CPA's role to a strategic business partner. Business owners seek a trusted advisor to help them steer challenges and grow, not just manage numbers.

Emphasizing human-centric skills: AI cannot replicate the human connection and trust that business owners value. Skills like critical thinking, communication, and relationship building become even more paramount.

Blending financial expertise with tech savvy: The modern CPA must blend deep financial expertise with technological adeptness, knowing how to leverage AI tools and interpret their outputs.

How CPAs can use AI to increase their value: By embracing AI, CPAs can automate tasks, improve accuracy, and provide deeper insights. This frees them to focus on complex problem-solving and building stronger client relationships. Explore how CPAs can use AI to increase their value and solidify your role as an invaluable advisor.

Future Trends: What's Next for AI in Accounting?

The evolution of AI for accounting firms is accelerating. Staying ahead means understanding future industry trends.

Hyper-automation: Expect an expansion of automation from individual tasks to entire end-to-end processes, with AI orchestrating multiple tools and workflows seamlessly.

AI agents: The rise of "agentic AI" is a significant trend. These autonomous systems perform complex tasks with minimal human intervention. Their growing importance is signaled by new companies like uiAgent raising seed rounds to accelerate AI agent automation for accounting firms.

Advanced predictive analytics: AI's ability to decipher patterns in vast datasets will lead to more sophisticated predictive analytics, enhancing forecasting accuracy.

Deeper software integration: Nearly every accounting technology provider is exploring AI integration, which will result in seamless, embedded AI capabilities within existing software.

The rise of agentic AI and what it means for firms: Agentic AI promises to take automation to the next level, handling more complex, multi-step processes independently. For firms, this means greater efficiency and a further shift towards strategic oversight and client relationship management.

Conclusion: From Number Cruncher to Strategic Advisor

The journey into AI for accounting firms is a paradigm shift redefining efficiency, accuracy, and client value. AI offers the opportunity to shed repetitive tasks, mitigate costly errors, and transform your role from a reactive number-cruncher into a proactive, strategic advisor. Firms that accept this evolution will thrive, attract top talent, and command higher valuations.

At WySMart.ai, we understand that leveraging AI effectively requires a strategy. That's why we empower accounting firms with an AI-powered website and digital marketing platform. We help you articulate your firm's unique value, attract the right clients, and market your new high-value advisory services. Our done-for-you AI toolbox ensures your online presence is as cutting-edge as your internal operations, from AI-optimized SEO to compelling content that converts.

Don't let your firm be part of the 56% who believe a firm's value drops without AI. Instead, lead the charge.

Book your demo today and see how WySMart.ai can help you lead the AI revolution in accounting, turning technological potential into tangible growth.

WySMart.ai: Your Done-For-You AI Toolbox for Accounting Firm Growth

Risk-free 7-day trial

Money-back guarantee

Start your journey: Book your demo today